Intro

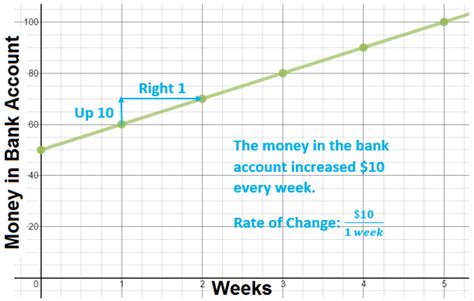

Excel is a powerful tool used for various calculations, including financial and statistical analysis. One of the key concepts in financial analysis is the rate of change, which measures the percentage change in a value over a specific period. The rate of change is crucial in understanding trends, making predictions, and evaluating performance. In this article, we will delve into the world of Excel and explore how to calculate the rate of change, its importance, and its applications.

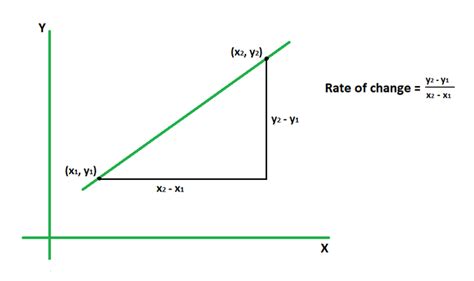

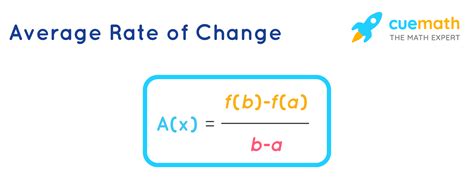

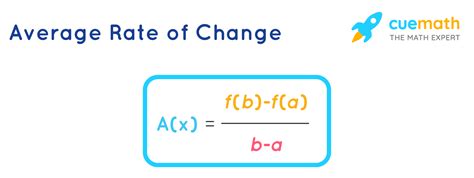

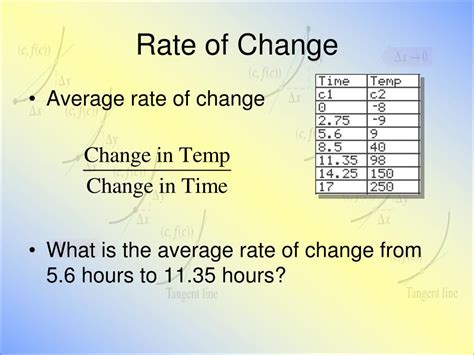

The rate of change is a fundamental concept in finance, and it is used to measure the percentage change in a value over a specific period. It is calculated by subtracting the initial value from the final value, dividing the result by the initial value, and then multiplying by 100. The formula for calculating the rate of change is: ((New Value - Old Value) / Old Value) * 100. This formula can be applied to various scenarios, including stock prices, revenue growth, and population increase.

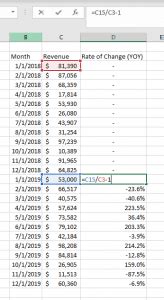

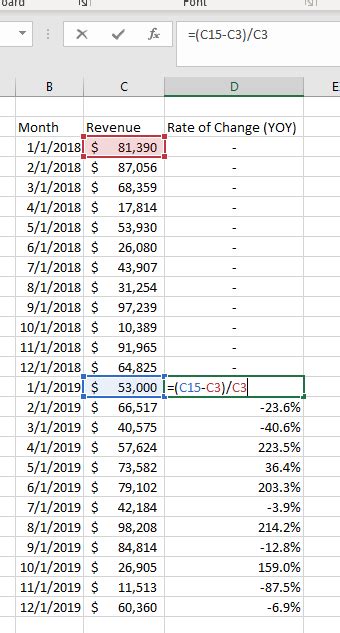

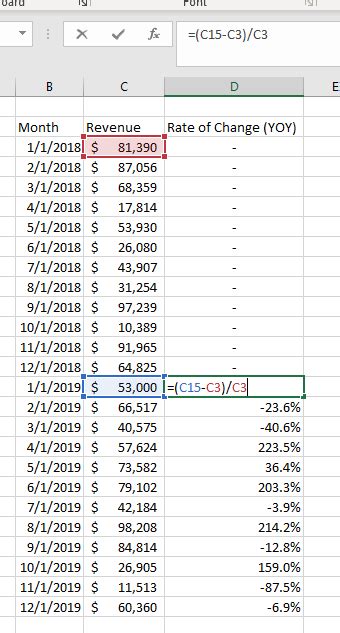

Calculating Rate of Change in Excel

Calculating the rate of change in Excel is straightforward. You can use the formula: ((New Value - Old Value) / Old Value) * 100. For example, if you want to calculate the rate of change in stock prices, you can use the following formula: =((B2-A2)/A2)*100, where A2 is the initial stock price and B2 is the final stock price. You can also use the RATE function in Excel, which calculates the rate of return for a given investment.

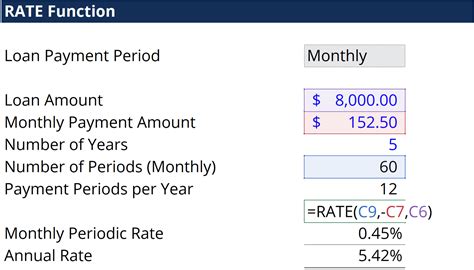

Using the RATE Function

The RATE function in Excel is used to calculate the rate of return for a given investment. The syntax for the RATE function is: RATE(nper, pmt, pv, [fv], [type], [guess]). The nper argument is the number of periods, the pmt argument is the payment made each period, the pv argument is the present value, the fv argument is the future value, the type argument is the type of investment, and the guess argument is the estimated rate of return.Importance of Rate of Change

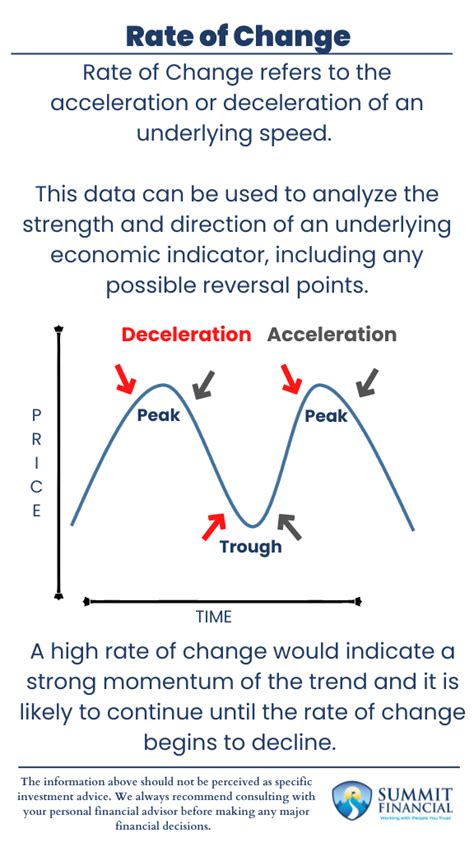

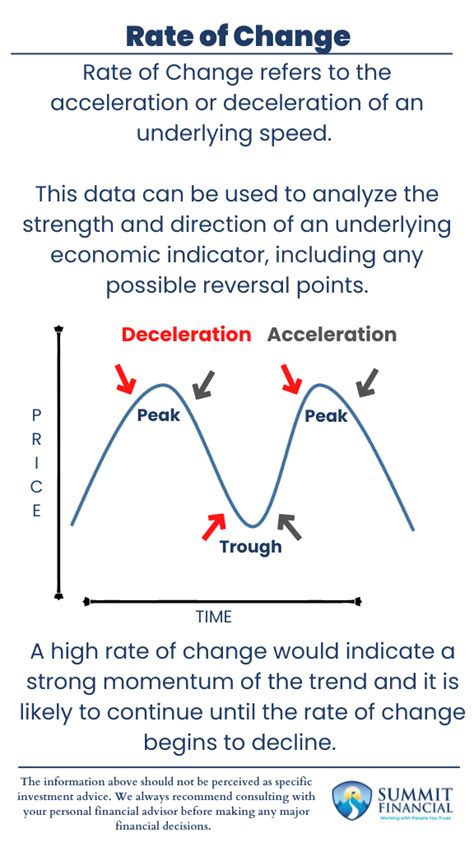

The rate of change is a crucial concept in finance, and it has several applications. It is used to evaluate performance, make predictions, and understand trends. For example, a company can use the rate of change to evaluate its revenue growth over a specific period. A high rate of change indicates rapid growth, while a low rate of change indicates slow growth. Investors can also use the rate of change to evaluate the performance of their investments.

Applications of Rate of Change

The rate of change has several applications in finance, including: * Evaluating performance: The rate of change is used to evaluate the performance of a company, investment, or asset. * Making predictions: The rate of change is used to make predictions about future trends and patterns. * Understanding trends: The rate of change is used to understand trends and patterns in data. * Evaluating risk: The rate of change is used to evaluate the risk associated with an investment or asset.Rate of Change Formula

The rate of change formula is: ((New Value - Old Value) / Old Value) * 100. This formula can be applied to various scenarios, including stock prices, revenue growth, and population increase. For example, if you want to calculate the rate of change in stock prices, you can use the following formula: =((B2-A2)/A2)*100, where A2 is the initial stock price and B2 is the final stock price.

Example of Rate of Change

Suppose you want to calculate the rate of change in stock prices. The initial stock price is $100, and the final stock price is $120. Using the formula: ((New Value - Old Value) / Old Value) * 100, you can calculate the rate of change as follows: =((120-100)/100)*100 = 20%. This means that the stock price increased by 20% over the specific period.Rate of Change in Excel Chart

You can also display the rate of change in an Excel chart. To do this, you need to create a line chart or a column chart, and then add a trendline to the chart. The trendline will display the rate of change over the specific period. You can also use the Moving Average function in Excel to calculate the rate of change over a specific period.

Using the Moving Average Function

The Moving Average function in Excel is used to calculate the average value of a range of cells over a specific period. The syntax for the Moving Average function is: AVERAGE(range). The range argument is the range of cells that you want to average. You can use the Moving Average function to calculate the rate of change over a specific period by subtracting the initial value from the final value, dividing the result by the initial value, and then multiplying by 100.Rate of Change Analysis

The rate of change analysis is used to evaluate the performance of a company, investment, or asset over a specific period. The analysis involves calculating the rate of change using the formula: ((New Value - Old Value) / Old Value) * 100. The result is then used to evaluate the performance of the company, investment, or asset. For example, a high rate of change indicates rapid growth, while a low rate of change indicates slow growth.

Example of Rate of Change Analysis

Suppose you want to evaluate the performance of a company over a specific period. The initial revenue is $100,000, and the final revenue is $120,000. Using the formula: ((New Value - Old Value) / Old Value) * 100, you can calculate the rate of change as follows: =((120000-100000)/100000)*100 = 20%. This means that the company's revenue increased by 20% over the specific period.Rate of Change Image Gallery

What is the rate of change formula?

+The rate of change formula is: ((New Value - Old Value) / Old Value) * 100.

How do I calculate the rate of change in Excel?

+You can calculate the rate of change in Excel using the formula: =((New Value - Old Value) / Old Value) * 100.

What is the importance of rate of change?

+The rate of change is important because it helps to evaluate performance, make predictions, and understand trends.

How do I display the rate of change in an Excel chart?

+You can display the rate of change in an Excel chart by creating a line chart or a column chart, and then adding a trendline to the chart.

What is the difference between the RATE function and the rate of change formula?

+The RATE function is used to calculate the rate of return for a given investment, while the rate of change formula is used to calculate the percentage change in a value over a specific period.

We hope this article has provided you with a comprehensive understanding of the rate of change in Excel. The rate of change is a crucial concept in finance, and it has several applications. By using the rate of change formula and the RATE function in Excel, you can evaluate performance, make predictions, and understand trends. If you have any questions or need further clarification, please do not hesitate to comment below. We would be happy to hear from you and provide any additional information you may need.