Intro

Calculating returns is a crucial aspect of investing, as it helps individuals understand the performance of their investments and make informed decisions. Returns can be calculated in various ways, depending on the type of investment, the time frame, and the investor's goals. In this article, we will explore five ways to calculate returns, providing a comprehensive overview of each method and its applications.

The importance of calculating returns cannot be overstated. It allows investors to evaluate the success of their investments, compare them to benchmarks, and adjust their strategies accordingly. Moreover, calculating returns helps investors to identify areas of improvement, optimize their portfolios, and achieve their financial objectives. With the numerous methods available, it is essential to understand the strengths and limitations of each approach to make accurate calculations and informed decisions.

The calculation of returns is a fundamental concept in finance, and its significance extends beyond individual investors to institutions and financial markets. It is used to assess the performance of mutual funds, exchange-traded funds, and other investment vehicles. Furthermore, calculating returns is essential for risk management, as it helps investors to understand the potential downsides of their investments and take steps to mitigate them. By grasping the different methods of calculating returns, investors can navigate the complex world of finance with confidence and achieve their long-term goals.

Introduction to Calculating Returns

Method 1: Simple Return

Example of Simple Return

For example, let's say an investor buys a stock for $100 and sells it for $120. The simple return would be: Simple Return = (Final Value - Initial Investment) / Initial Investment Simple Return = ($120 - $100) / $100 Simple Return = 20%Method 2: Compound Annual Growth Rate (CAGR)

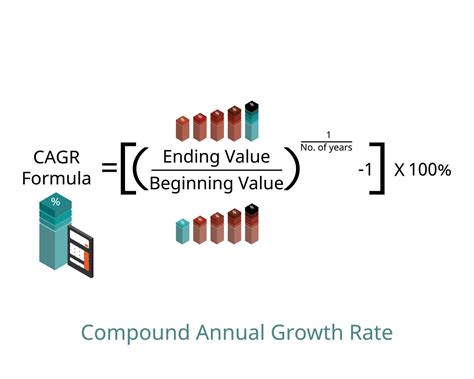

Example of CAGR

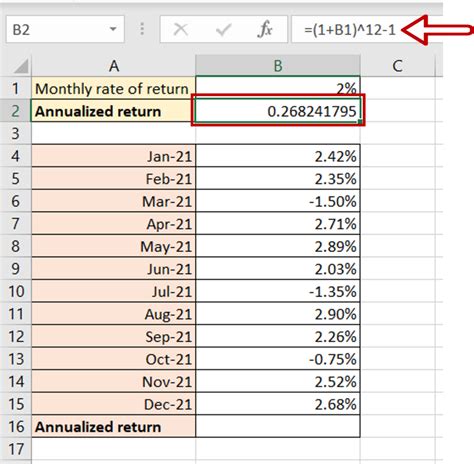

For example, let's say an investor buys a stock for $100 and sells it for $150 after 3 years. The CAGR would be: CAGR = ($150 / $100)^(1 / 3) - 1 CAGR = 14.47%Method 3: Time-Weighted Return

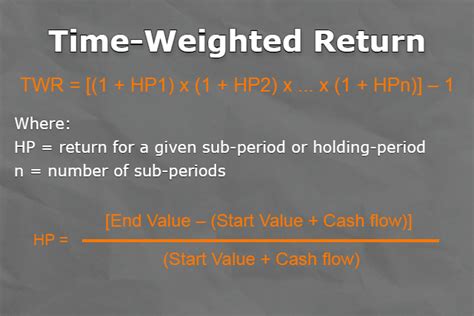

Example of Time-Weighted Return

For example, let's say an investor buys a stock for $100 and sells it for $120 after 2 years. The time-weighted return would be: Time-Weighted Return = (1 + ($120 - $100) / $100)^(1 / 2) - 1 Time-Weighted Return = 10%Method 4: Money-Weighted Return

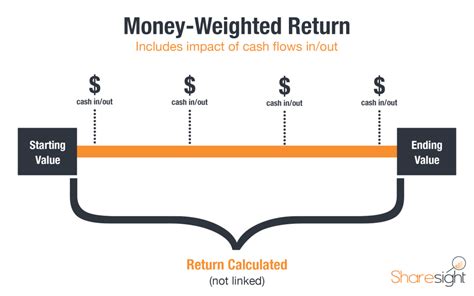

Example of Money-Weighted Return

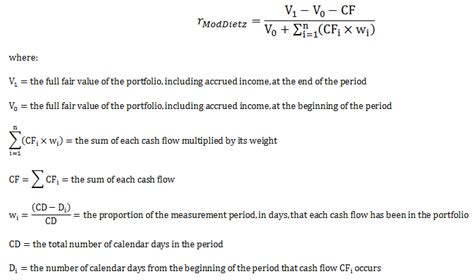

For example, let's say an investor buys a stock for $100 and sells it for $150. The money-weighted return would be: Money-Weighted Return = ($150 / $100) - 1 Money-Weighted Return = 50%Method 5: Modified Dietz Return

Example of Modified Dietz Return

For example, let's say an investor buys a stock for $100 and sells it for $120. The modified Dietz return would be: Modified Dietz Return = ($120 - $100) / $100 / (1 + ($120 - $100) / $100) Modified Dietz Return = 16.67%Calculating Returns Image Gallery

What is the importance of calculating returns?

+Calculating returns is essential to evaluate the performance of an investment, compare it to benchmarks, and make informed decisions.

What are the different methods of calculating returns?

+There are several methods to calculate returns, including simple return, compound annual growth rate (CAGR), time-weighted return, money-weighted return, and modified Dietz return.

How do I choose the right method to calculate returns?

+The choice of method depends on the investor's goals, the type of investment, and the time frame. It is essential to understand the strengths and limitations of each approach to make accurate calculations and informed decisions.

What is the difference between time-weighted return and money-weighted return?

+Time-weighted return takes into account the timing and size of cash flows, while money-weighted return is based on the amount of money invested. Time-weighted return is more suitable for evaluating the performance of a portfolio, while money-weighted return is more suitable for evaluating the performance of an individual investment.

How can I use calculating returns to improve my investment strategy?

+Calculating returns can help you evaluate the performance of your investments, identify areas of improvement, and adjust your strategy accordingly. By using the right method to calculate returns, you can make informed decisions, optimize your portfolio, and achieve your financial objectives.

In conclusion, calculating returns is a vital aspect of investing, and understanding the different methods is essential to make accurate calculations and informed decisions. By applying the methods outlined in this article, investors can evaluate the performance of their investments, compare them to benchmarks, and adjust their strategies to achieve their financial objectives. We invite you to share your thoughts and experiences with calculating returns, and we encourage you to explore the various methods and tools available to optimize your investment strategy.