Intro

Calculate investment returns with ease. Learn how to compute payback period in Excel using formulas and templates, optimizing cash flow analysis and ROI evaluation.

The payback period is a crucial metric in finance that helps investors and businesses determine the time it takes for an investment to generate returns equal to its initial cost. Computing the payback period in Excel is a straightforward process that can be accomplished using various methods. In this article, we will delve into the importance of the payback period, its calculation, and how to compute it in Excel.

The payback period is essential in evaluating investment opportunities, as it provides insights into the liquidity and risk associated with an investment. A shorter payback period indicates that an investment is less risky and more liquid, while a longer payback period suggests higher risk and lower liquidity. Investors and businesses use the payback period to compare different investment opportunities and make informed decisions.

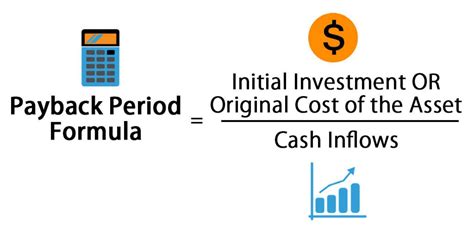

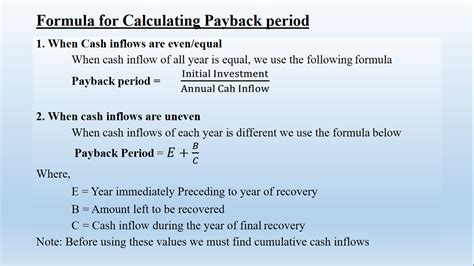

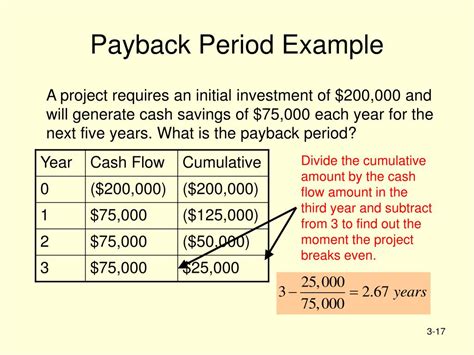

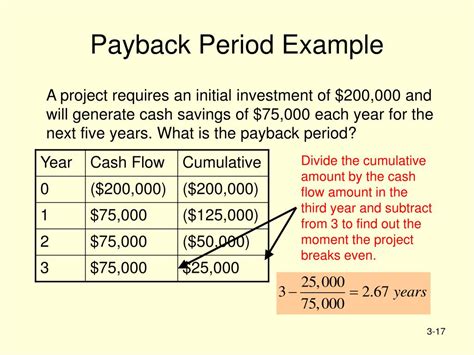

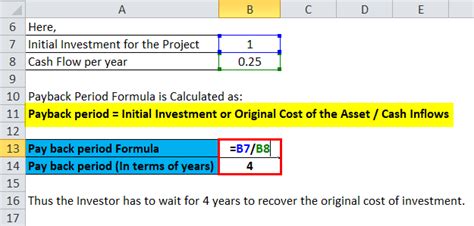

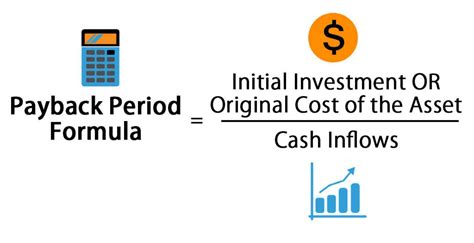

To calculate the payback period, you need to know the initial investment, the annual cash inflows, and the discount rate. The payback period can be calculated using the formula: Payback Period = Initial Investment / Annual Cash Inflows. However, this formula assumes that the cash inflows are uniform and do not take into account the time value of money. To get a more accurate calculation, you can use the discounted cash flow (DCF) method, which takes into account the time value of money.

Understanding the Payback Period Formula

The payback period formula is a simple and intuitive way to calculate the payback period. However, it has its limitations, as it does not take into account the time value of money. The formula is as follows: Payback Period = Initial Investment / Annual Cash Inflows. For example, if the initial investment is $100,000 and the annual cash inflows are $20,000, the payback period would be 5 years.

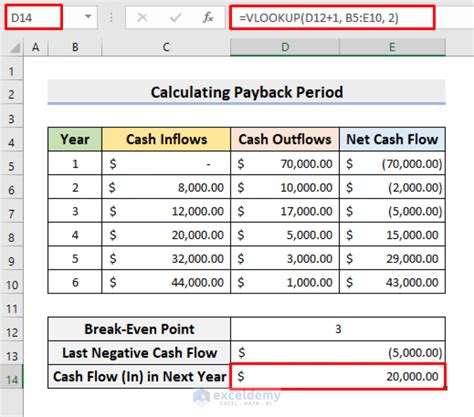

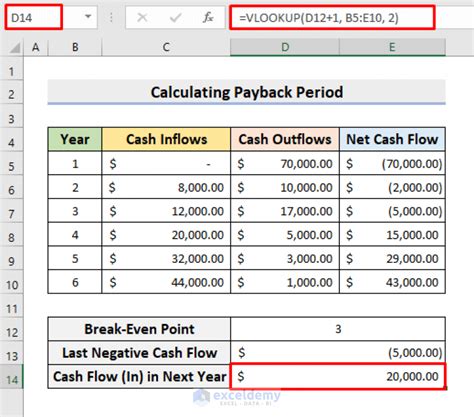

Computing Payback Period in Excel

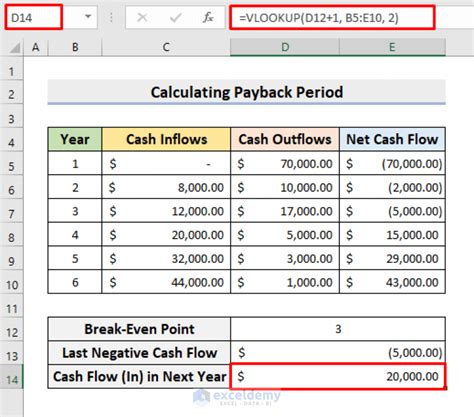

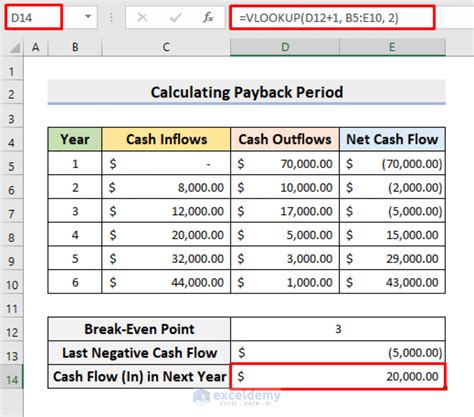

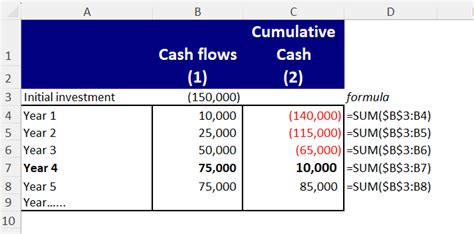

To compute the payback period in Excel, you can use the following steps:

- Enter the initial investment, annual cash inflows, and discount rate into separate cells.

- Use the formula = Initial Investment / Annual Cash Inflows to calculate the payback period.

- Alternatively, you can use the XNPV function in Excel, which calculates the present value of a series of cash flows.

- Use the XNPV function to calculate the present value of the cash inflows, and then use the formula = Initial Investment / XNPV to calculate the payback period.

Using the XNPV Function in Excel

The XNPV function in Excel is a powerful tool for calculating the present value of a series of cash flows. The function takes into account the time value of money and provides a more accurate calculation of the payback period. To use the XNPV function, you need to enter the following parameters:- Rate: The discount rate

- Dates: The dates of the cash flows

- Cash flows: The amounts of the cash flows

For example, if you have an initial investment of $100,000, annual cash inflows of $20,000, and a discount rate of 10%, you can use the XNPV function to calculate the present value of the cash inflows.

Example of Computing Payback Period in Excel

Let's consider an example of computing the payback period in Excel. Suppose we have an initial investment of $100,000, annual cash inflows of $20,000, and a discount rate of 10%. We can use the following steps to calculate the payback period:

- Enter the initial investment, annual cash inflows, and discount rate into separate cells.

- Use the formula = Initial Investment / Annual Cash Inflows to calculate the payback period.

- Alternatively, we can use the XNPV function to calculate the present value of the cash inflows, and then use the formula = Initial Investment / XNPV to calculate the payback period.

Using the XNPV function, we get a present value of $124,179. The payback period would be approximately 5.02 years.

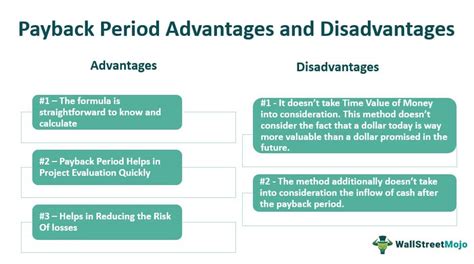

Advantages and Limitations of the Payback Period

The payback period has several advantages, including:

- Easy to calculate and understand

- Provides a quick estimate of the time it takes for an investment to generate returns

- Helps investors and businesses compare different investment opportunities

However, the payback period also has several limitations, including:

- Does not take into account the time value of money

- Does not consider the risk associated with an investment

- Does not provide a complete picture of the investment's potential returns

Conclusion and Next Steps

In conclusion, computing the payback period in Excel is a straightforward process that can be accomplished using various methods. The payback period is an essential metric in finance that helps investors and businesses evaluate investment opportunities and make informed decisions. While the payback period has its limitations, it provides a quick estimate of the time it takes for an investment to generate returns and helps investors and businesses compare different investment opportunities.

To take your knowledge to the next level, we recommend exploring other financial metrics, such as the internal rate of return (IRR) and the net present value (NPV). These metrics provide a more comprehensive picture of an investment's potential returns and help investors and businesses make more informed decisions.

Gallery of Payback Period Examples

Payback Period Image Gallery

What is the payback period?

+The payback period is the time it takes for an investment to generate returns equal to its initial cost.

How do I calculate the payback period in Excel?

+You can calculate the payback period in Excel using the formula = Initial Investment / Annual Cash Inflows or by using the XNPV function.

What are the advantages and limitations of the payback period?

+The payback period has several advantages, including ease of calculation and providing a quick estimate of the time it takes for an investment to generate returns. However, it also has several limitations, including not taking into account the time value of money and not considering the risk associated with an investment.

We hope this article has provided you with a comprehensive understanding of the payback period and how to compute it in Excel. If you have any questions or need further clarification, please don't hesitate to comment below. Share this article with your friends and colleagues who may benefit from learning about the payback period. Take the next step in your financial journey by exploring other financial metrics and tools that can help you make informed investment decisions.