Intro

Calculate option profits with ease using an Excel calculator, optimizing trading strategies with Greeks, volatility, and risk management, for informed investment decisions.

Option trading has become a popular investment strategy for many traders and investors. With the rise of online trading platforms, it has become easier for individuals to participate in the options market. However, to make informed decisions, it is essential to have a solid understanding of options pricing and the potential profits and losses associated with each trade. This is where an option profit calculator Excel spreadsheet can be a valuable tool.

The importance of having a reliable option profit calculator cannot be overstated. It helps traders to evaluate the potential risks and rewards of each trade, making it easier to make informed decisions. Moreover, it saves time and reduces the likelihood of errors, which can be costly in the world of options trading. In this article, we will delve into the world of option profit calculators, exploring their benefits, how they work, and providing a step-by-step guide on creating an option profit calculator Excel spreadsheet.

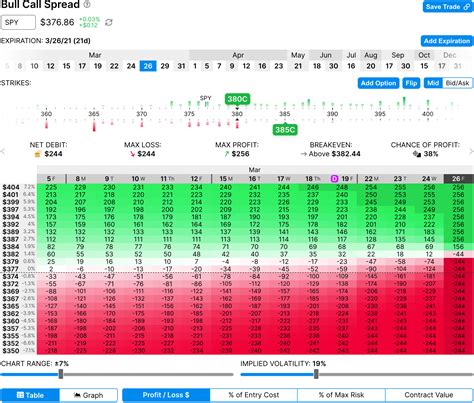

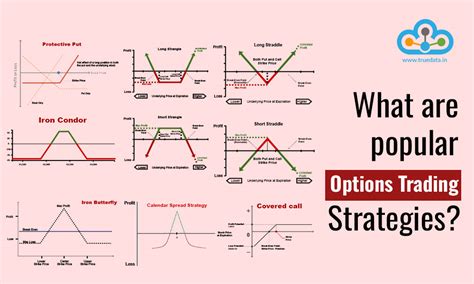

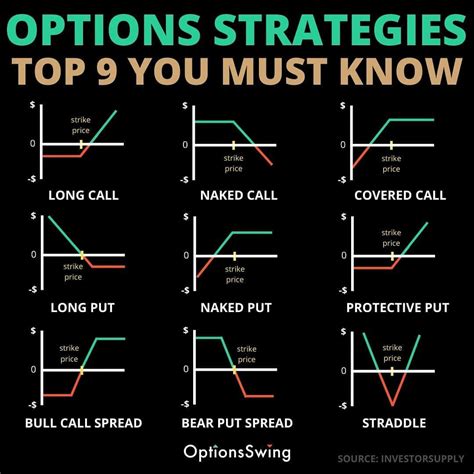

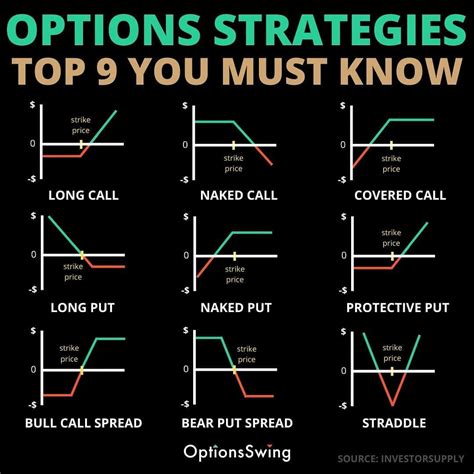

An option profit calculator is a tool used to calculate the potential profit or loss of an options trade. It takes into account various factors, including the type of option, strike price, expiration date, underlying asset price, and volatility. By using an option profit calculator, traders can quickly and easily evaluate the potential outcomes of each trade, making it easier to manage risk and maximize returns.

The benefits of using an option profit calculator are numerous. For one, it helps traders to set realistic expectations and make informed decisions. By understanding the potential profits and losses associated with each trade, traders can adjust their strategies accordingly, minimizing risk and maximizing returns. Additionally, an option profit calculator can help traders to identify potential trading opportunities, making it easier to stay ahead of the market.

To create an option profit calculator Excel spreadsheet, traders will need to have a basic understanding of options trading and Excel. The spreadsheet will require several inputs, including the type of option, strike price, expiration date, underlying asset price, and volatility. Using these inputs, the spreadsheet can calculate the potential profit or loss of each trade, providing traders with a valuable tool for evaluating trading opportunities.

How to Create an Option Profit Calculator Excel Spreadsheet

Creating an option profit calculator Excel spreadsheet is a relatively straightforward process. The first step is to set up the spreadsheet, creating columns for the various inputs, including the type of option, strike price, expiration date, underlying asset price, and volatility. Next, traders will need to create formulas to calculate the potential profit or loss of each trade. This can be done using a combination of Excel functions, including IF statements, conditional formatting, and financial functions.

To calculate the potential profit or loss of each trade, traders will need to use a combination of formulas. For example, to calculate the profit of a call option, traders can use the following formula: Profit = (Underlying Asset Price - Strike Price) x Number of Contracts. To calculate the loss, traders can use the following formula: Loss = (Strike Price - Underlying Asset Price) x Number of Contracts.

Key Components of an Option Profit Calculator Excel Spreadsheet

An option profit calculator Excel spreadsheet typically consists of several key components, including:

- Input section: This is where traders enter the various inputs, including the type of option, strike price, expiration date, underlying asset price, and volatility.

- Calculation section: This is where the spreadsheet calculates the potential profit or loss of each trade, using the inputs from the input section.

- Output section: This is where the spreadsheet displays the results, providing traders with a clear and concise overview of the potential profits and losses associated with each trade.

By using an option profit calculator Excel spreadsheet, traders can quickly and easily evaluate the potential outcomes of each trade, making it easier to manage risk and maximize returns. Additionally, the spreadsheet can be customized to meet the specific needs of each trader, providing a valuable tool for evaluating trading opportunities.

Benefits of Using an Option Profit Calculator Excel Spreadsheet

The benefits of using an option profit calculator Excel spreadsheet are numerous. Some of the key benefits include:

- Improved accuracy: By using a spreadsheet to calculate the potential profit or loss of each trade, traders can reduce the likelihood of errors, which can be costly in the world of options trading.

- Increased efficiency: An option profit calculator Excel spreadsheet can save traders a significant amount of time, making it easier to evaluate trading opportunities and make informed decisions.

- Enhanced risk management: By understanding the potential profits and losses associated with each trade, traders can adjust their strategies accordingly, minimizing risk and maximizing returns.

- Customization: An option profit calculator Excel spreadsheet can be customized to meet the specific needs of each trader, providing a valuable tool for evaluating trading opportunities.

Overall, an option profit calculator Excel spreadsheet is a valuable tool for any trader or investor looking to participate in the options market. By providing a clear and concise overview of the potential profits and losses associated with each trade, traders can make informed decisions, manage risk, and maximize returns.

Common Mistakes to Avoid When Using an Option Profit Calculator Excel Spreadsheet

When using an option profit calculator Excel spreadsheet, there are several common mistakes to avoid. Some of the key mistakes include:

- Failure to update inputs: Failing to update the inputs, such as the underlying asset price and volatility, can result in inaccurate calculations, leading to poor trading decisions.

- Incorrect formulas: Using incorrect formulas or failing to update the formulas can result in inaccurate calculations, leading to poor trading decisions.

- Lack of customization: Failing to customize the spreadsheet to meet the specific needs of each trader can result in a lack of relevance, making it difficult to evaluate trading opportunities.

By avoiding these common mistakes, traders can ensure that their option profit calculator Excel spreadsheet is accurate, efficient, and effective, providing a valuable tool for evaluating trading opportunities.

Conclusion and Final Thoughts

In conclusion, an option profit calculator Excel spreadsheet is a valuable tool for any trader or investor looking to participate in the options market. By providing a clear and concise overview of the potential profits and losses associated with each trade, traders can make informed decisions, manage risk, and maximize returns. Whether you are a seasoned trader or just starting out, an option profit calculator Excel spreadsheet can help you to navigate the complex world of options trading, providing a valuable tool for evaluating trading opportunities.

By following the steps outlined in this article, traders can create their own option profit calculator Excel spreadsheet, customizing it to meet their specific needs. Additionally, by avoiding common mistakes and using the spreadsheet in conjunction with other trading tools, traders can ensure that they are making informed decisions, minimizing risk, and maximizing returns.

Option Trading Image Gallery

What is an option profit calculator?

+An option profit calculator is a tool used to calculate the potential profit or loss of an options trade.

How do I create an option profit calculator Excel spreadsheet?

+To create an option profit calculator Excel spreadsheet, traders will need to set up the spreadsheet, creating columns for the various inputs, including the type of option, strike price, expiration date, underlying asset price, and volatility.

What are the benefits of using an option profit calculator Excel spreadsheet?

+The benefits of using an option profit calculator Excel spreadsheet include improved accuracy, increased efficiency, enhanced risk management, and customization.

We hope this article has provided you with a comprehensive understanding of option profit calculators and how to create an option profit calculator Excel spreadsheet. Whether you are a seasoned trader or just starting out, an option profit calculator Excel spreadsheet can help you to navigate the complex world of options trading, providing a valuable tool for evaluating trading opportunities. If you have any questions or comments, please feel free to share them below. Additionally, if you found this article helpful, please share it with others who may benefit from this information.