Intro

Calculate savings with our Balance Transfer Calculator Excel Tool, optimizing debt consolidation, credit card refinancing, and interest rate reduction strategies, to achieve financial freedom.

Managing debt effectively is a crucial aspect of personal finance, and one strategy that can help individuals save money on interest payments is by using a balance transfer. A balance transfer involves moving an outstanding balance from one credit card to another, often to take advantage of a lower interest rate. To make informed decisions about balance transfers, utilizing a balance transfer calculator can be highly beneficial. Among the various tools available, an Excel balance transfer calculator stands out for its flexibility, customization capabilities, and ease of use.

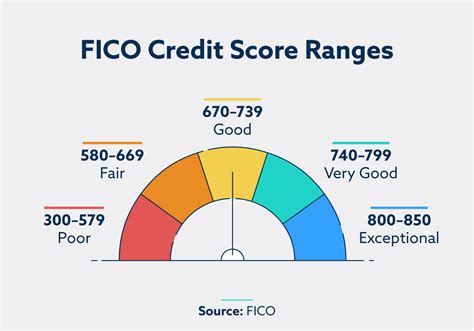

For individuals dealing with credit card debt, understanding the implications of a balance transfer is essential. It's not just about moving debt from one card to another; it's about potentially saving hundreds or even thousands of dollars in interest over time. The process involves identifying a credit card with a lower interest rate, preferably a 0% introductory APR, and transferring the balance to this new card. However, the decision to do so should be based on careful consideration of the terms and conditions, including the duration of the introductory APR period, the balance transfer fee, and the regular APR that will apply after the introductory period ends.

The benefits of using a balance transfer calculator, especially one designed in Excel, are numerous. Firstly, it allows individuals to input their specific financial data, such as the current balance, interest rate, and minimum monthly payment, to get a personalized view of their debt situation. Secondly, by adjusting variables like the new interest rate and balance transfer fee, users can simulate different scenarios to find the most cost-effective option. This level of customization is a significant advantage over generic online calculators that may not account for all the nuances of an individual's financial situation.

How to Use a Balance Transfer Calculator Excel Tool

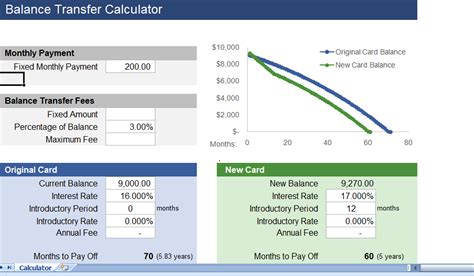

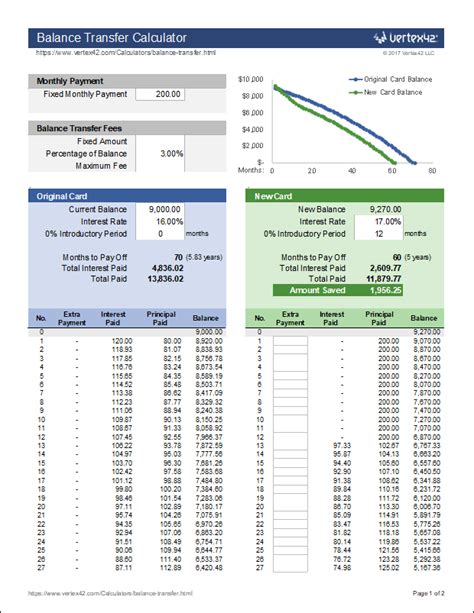

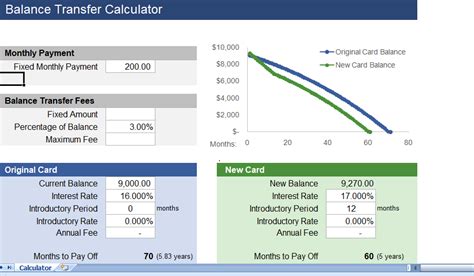

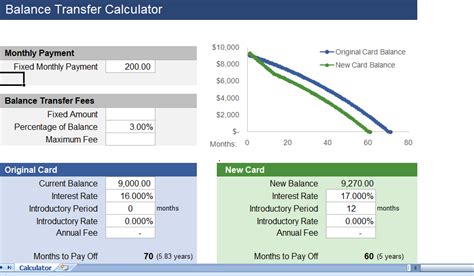

Using a balance transfer calculator in Excel is relatively straightforward. The first step is to input the current credit card balance, the current interest rate, and the minimum monthly payment. Users should also consider the balance transfer fee, which is usually a percentage of the transferred balance, and the introductory APR period of the new credit card. With this information, the calculator can determine how much interest will be saved by transferring the balance to a new card with a lower interest rate.

One of the key features of an Excel balance transfer calculator is its ability to calculate the payoff period and the total interest paid over this period, both with and without the balance transfer. By comparing these figures, individuals can clearly see the potential benefits of a balance transfer. For example, if the current credit card has an 18% APR and a $2,000 balance, and the new credit card offers a 0% APR for 12 months with a 3% balance transfer fee, the calculator can show how much money can be saved in interest by making the transfer.

Benefits of Balance Transfer Calculators

The benefits of balance transfer calculators extend beyond just the financial savings. They also provide a tool for individuals to take control of their debt and make informed decisions about their financial future. By understanding the true cost of their debt and exploring options for reducing this cost, individuals can develop a more proactive approach to managing their finances.

Another significant advantage of using an Excel balance transfer calculator is the ability to scenario plan. Users can experiment with different balance transfer fees, interest rates, and payment amounts to see how these variables impact the payoff period and total interest paid. This level of flexibility is invaluable for making informed decisions, as it allows individuals to consider multiple "what if" scenarios before committing to a balance transfer.

Creating a Balance Transfer Calculator in Excel

For those who prefer a more hands-on approach or have specific requirements not met by existing calculators, creating a balance transfer calculator in Excel from scratch is a viable option. This involves setting up a spreadsheet with input fields for the current balance, interest rate, minimum payment, and other relevant details. Users can then use Excel's formula capabilities to calculate the payoff period, total interest paid, and other key metrics.

The process begins with identifying the necessary inputs and outputs. Inputs might include the current balance, current APR, minimum monthly payment, new APR, balance transfer fee, and desired monthly payment. Outputs could include the payoff period, total interest paid, and monthly payment amount. With these defined, users can start building the calculator using Excel formulas.

Excel Formulas for Balance Transfer Calculators

Excel offers a range of formulas that can be used to calculate the payoff period and total interest paid, including the PMT function for calculating the monthly payment and the IPMT and PPMT functions for calculating the interest and principal components of a payment. By combining these formulas with the input values, users can create a dynamic calculator that updates automatically when any of the inputs are changed.

For example, the formula to calculate the monthly payment (M) on a loan can be expressed as M = P[r(1+r)^n]/[(1+r)^n – 1], where P is the principal loan amount, r is the monthly interest rate, and n is the number of payments. This formula can be implemented in Excel using the PMT function: PMT(r, n, P), where r is the interest rate per period, n is the total number of payment periods, and P is the present value (the initial amount of the loan).

Best Practices for Using a Balance Transfer Calculator

When using a balance transfer calculator, there are several best practices to keep in mind. Firstly, ensure that all inputs are accurate and up-to-date, as small discrepancies can lead to significant differences in the calculated outcomes. Secondly, consider all fees associated with the balance transfer, including the balance transfer fee and any potential late fees. Thirdly, make sure to understand the terms of the new credit card, including the length of the introductory APR period and the regular APR that will apply afterward.

Additionally, it's crucial to have a plan for paying off the debt during the introductory period. This might involve increasing monthly payments or making extra payments whenever possible. By doing so, individuals can maximize the benefits of the balance transfer and avoid accumulating more debt.

Tips for Paying Off Debt with a Balance Transfer

Paying off debt using a balance transfer requires discipline and a well-thought-out strategy. One tip is to prioritize debt repayment by allocating as much as possible towards the debt each month. Another tip is to avoid new credit card purchases during the introductory period, as this can make it more challenging to pay off the principal balance.

Furthermore, individuals should consider setting up automatic payments to ensure that they never miss a payment. Missing payments can result in late fees and may even cause the credit card issuer to end the introductory APR period prematurely.

Balance Transfer Calculator Image Gallery

What is a balance transfer, and how does it work?

+A balance transfer involves moving an outstanding balance from one credit card to another, often to take advantage of a lower interest rate. This can help save money on interest payments over time.

How can I use a balance transfer calculator to my advantage?

+By inputting your specific financial data into a balance transfer calculator, you can get a personalized view of your debt situation and explore different scenarios to find the most cost-effective option for paying off your debt.

What are some common mistakes to avoid when doing a balance transfer?

+Common mistakes include not understanding all the terms and conditions of the new credit card, accumulating new debt during the introductory period, and not having a plan to pay off the debt before the regular APR kicks in.

In conclusion, utilizing a balance transfer calculator, especially one designed in Excel, can be a powerful tool in managing credit card debt effectively. By understanding the benefits and potential pitfalls of balance transfers and using a calculator to inform their decisions, individuals can make significant strides in paying off their debt and improving their financial health. Whether you're dealing with high-interest debt or simply looking for ways to optimize your financial strategy, exploring the capabilities of a balance transfer calculator is a step in the right direction. So, take the first step today, and start navigating your path towards a debt-free future with confidence and clarity.