Intro

Adjust for inflation with Excel formulas, using CPI data and indexing to calculate real values, ensuring accurate financial analysis and forecasting with inflation rate adjustments.

Inflation is a persistent economic phenomenon that affects the purchasing power of money over time. As prices rise, the value of money decreases, and it becomes essential to adjust financial calculations to reflect this change. In Excel, you can use various formulas to adjust for inflation, ensuring that your financial models and projections remain accurate. Understanding these formulas is crucial for businesses, investors, and individuals who need to make informed decisions based on future value projections.

The importance of adjusting for inflation cannot be overstated. Without it, financial projections can be misleading, leading to poor investment decisions or inaccurate budgeting. Inflation adjustment formulas help in understanding the true value of money over time, allowing for more precise financial planning. Whether you're calculating the future value of an investment, the present value of a future cash flow, or simply adjusting historical data for inflation, Excel provides a range of tools and formulas to help.

Inflation adjustment is not just about understanding economic principles; it's also about applying these principles in practical scenarios. For instance, when calculating the cost of living adjustments for salaries or pensions, inflation adjustment formulas are indispensable. They help in maintaining the purchasing power of individuals, ensuring that their standard of living does not degrade over time due to inflation. Similarly, in business, these formulas are used to adjust production costs, pricing strategies, and investment returns, making them a critical component of financial analysis.

Understanding Inflation Adjustment Formulas

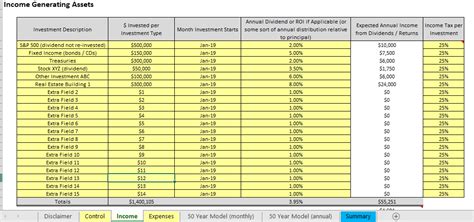

To adjust for inflation in Excel, you can use several formulas, depending on the specific requirement of your analysis. The most common approach involves using the Consumer Price Index (CPI) or a similar inflation rate metric. Here are some key formulas and concepts:

-

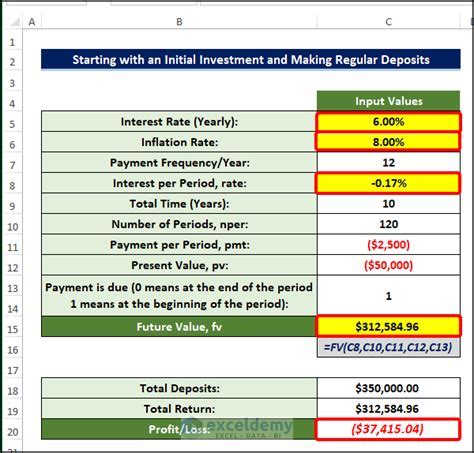

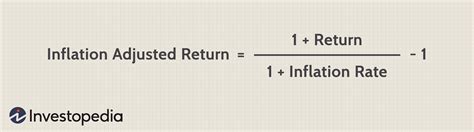

Future Value (FV) Formula with Inflation: The FV formula calculates the future value of an investment based on its current value, interest rate, and the number of periods. To adjust for inflation, you can modify the interest rate to reflect the inflation rate. The formula is

FV = PV * (1 + r)^n, wherePVis the present value,ris the interest rate minus the inflation rate, andnis the number of periods. -

Present Value (PV) Formula with Inflation: Similarly, the PV formula calculates the present value of a future amount. Adjusting for inflation involves using the inflation rate to discount the future amount. The formula is

PV = FV / (1 + r)^n, whereFVis the future value,ris the discount rate plus the inflation rate, andnis the number of periods.

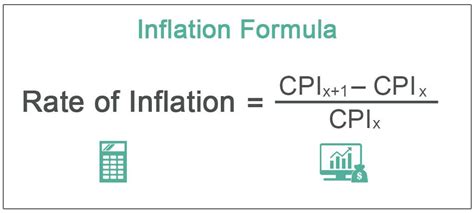

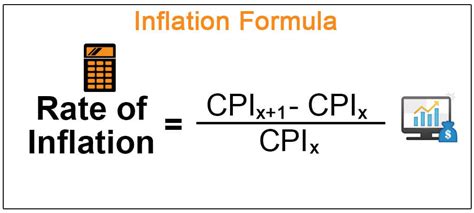

Calculating Inflation Rate

Calculating the inflation rate is a crucial step in adjusting for inflation. The inflation rate can be calculated using the formula: Inflation Rate = (End Year CPI - Start Year CPI) / Start Year CPI. This rate can then be used in various financial formulas to adjust for inflation.

Applying Inflation Adjustment Formulas in Excel

To apply these formulas in Excel, follow these steps:

-

Determine the Inflation Rate: First, you need to determine the inflation rate for the period you're analyzing. This can be done by calculating the difference in CPI over the period.

-

Calculate Future or Present Value: Use the FV or PV formula, adjusting the interest rate to account for inflation.

-

Use Excel Functions: Excel provides built-in functions like

FVandPVthat can be used directly in formulas. For example,=FV(rate, nper, pmt, [pv], [type])calculates the future value of an investment.

Practical Examples

Here are some practical examples to illustrate how inflation adjustment works:

- Example 1: Calculate the future value of $10,000 invested for 5 years with an annual interest rate of 5% and an inflation rate of 2%.

- Example 2: Determine the present value of $15,000 to be received in 3 years, with a discount rate of 4% and an inflation rate of 1.5%.

These examples can be calculated using the formulas mentioned above, adjusting the interest rates for inflation.

Inflation Adjustment and Financial Planning

Inflation adjustment is a critical component of financial planning. It helps in creating realistic financial projections, ensuring that savings and investments keep pace with inflation. Here are some tips for incorporating inflation adjustment into your financial planning:

- Long-term Projections: Always consider inflation when making long-term financial projections.

- Inflation-indexed Investments: Consider investments that are indexed to inflation, such as Treasury Inflation-Protected Securities (TIPS).

- Regular Review: Regularly review and adjust your financial plans to account for changes in inflation rates.

Common Mistakes to Avoid

When adjusting for inflation, there are several common mistakes to avoid:

- Ignoring Inflation: The most significant mistake is ignoring inflation altogether.

- Using Incorrect Inflation Rates: Using an incorrect inflation rate can lead to inaccurate financial projections.

- Not Adjusting for Compound Interest: Failing to account for compound interest can also lead to inaccuracies.

Inflation Adjustment Image Gallery

What is the importance of adjusting for inflation in financial planning?

+Adjusting for inflation is crucial because it helps in maintaining the purchasing power of money over time, ensuring that financial projections and savings keep pace with the rising cost of living.

How do you calculate the inflation rate?

+The inflation rate can be calculated using the formula: (End Year CPI - Start Year CPI) / Start Year CPI. This formula provides the percentage change in the Consumer Price Index over a specified period.

What are some common mistakes to avoid when adjusting for inflation?

+Common mistakes include ignoring inflation, using incorrect inflation rates, and not adjusting for compound interest. These mistakes can lead to inaccurate financial projections and poor investment decisions.

In conclusion, adjusting for inflation is a vital aspect of financial planning and analysis. By understanding and applying inflation adjustment formulas, individuals and businesses can make more accurate financial projections, ensuring that their savings and investments retain their value over time. Whether you're a seasoned financial analyst or just starting to plan your finances, incorporating inflation adjustment into your strategy is essential for long-term financial success. We invite you to share your thoughts on how you adjust for inflation in your financial planning and to explore more topics related to personal finance and investment strategies.