Intro

Saving money is an essential aspect of personal finance that can help individuals achieve their long-term goals, such as buying a house, retiring comfortably, or funding their children's education. However, with the rising cost of living and the temptation to spend, it can be challenging to save money. In this article, we will explore five effective ways to save money, helping you to develop healthy financial habits and secure your financial future.

The importance of saving money cannot be overstated. It provides a sense of security, reduces financial stress, and allows individuals to take advantage of investment opportunities. Moreover, saving money can help individuals to avoid debt, which can be a significant burden on their financial well-being. By developing a savings plan and sticking to it, individuals can achieve their financial goals and enjoy a more stable financial future.

In addition to the benefits mentioned above, saving money can also provide individuals with the freedom to pursue their passions and interests. When individuals have a financial safety net, they are more likely to take risks and explore new opportunities, which can lead to personal growth and fulfillment. Furthermore, saving money can help individuals to develop a sense of discipline and responsibility, which can have a positive impact on other areas of their lives.

Understanding the Importance of Saving

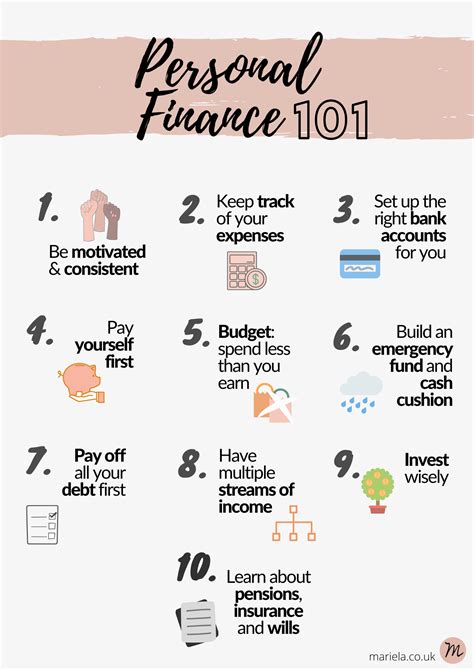

To develop effective savings habits, it is essential to understand the importance of saving. This involves setting clear financial goals, tracking expenses, and creating a budget. By understanding where their money is going, individuals can identify areas where they can cut back and allocate more funds towards savings. Moreover, setting clear financial goals can help individuals to stay motivated and focused on their savings objectives.

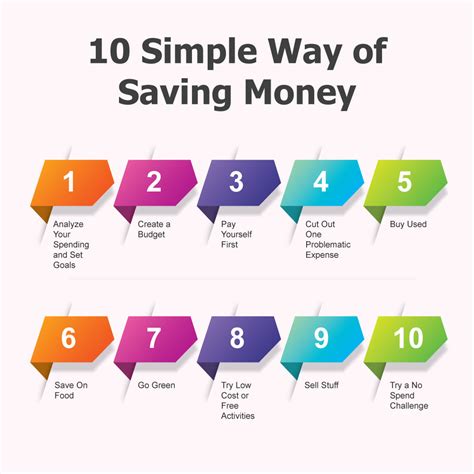

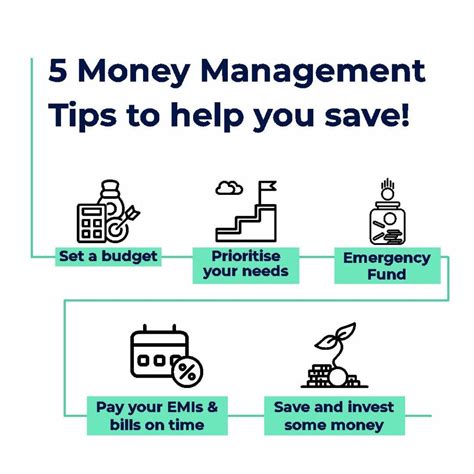

5 Ways to Save Money

There are several ways to save money, and the most effective approach will depend on an individual's financial situation and goals. Here are five ways to save money:

- Create a budget: A budget helps individuals to track their income and expenses, making it easier to identify areas where they can cut back and allocate more funds towards savings.

- Automate savings: Setting up automatic transfers from a checking account to a savings account can help individuals to save money consistently and avoid the temptation to spend.

- Cut back on expenses: Reducing expenses, such as canceling subscription services or finding ways to lower household bills, can help individuals to free up more money for savings.

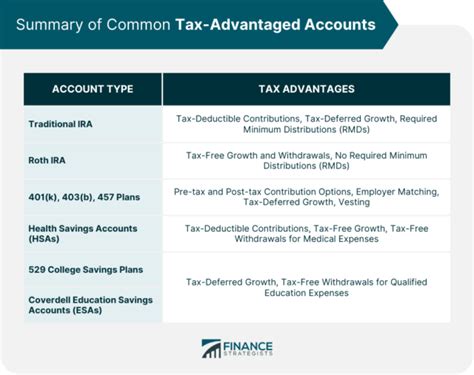

- Take advantage of tax-advantaged accounts: Utilizing tax-advantaged accounts, such as 401(k) or IRA accounts, can help individuals to save money for retirement while reducing their tax liability.

- Avoid debt: High-interest debt, such as credit card debt, can be a significant burden on an individual's financial well-being. Avoiding debt or paying off existing debt can help individuals to free up more money for savings.

Creating a Budget

Creating a budget is an essential step in developing effective savings habits. A budget helps individuals to track their income and expenses, making it easier to identify areas where they can cut back and allocate more funds towards savings. To create a budget, individuals should start by tracking their income and expenses over a month. This will help them to understand where their money is going and identify areas where they can cut back.

Steps to Create a Budget

To create a budget, follow these steps: 1. Track income and expenses: Start by tracking income and expenses over a month to understand where money is going. 2. Set financial goals: Identify financial goals, such as saving for a down payment on a house or retirement. 3. Categorize expenses: Categorize expenses into needs (housing, food, transportation) and wants (entertainment, hobbies). 4. Allocate funds: Allocate funds towards savings and essential expenses. 5. Review and adjust: Regularly review the budget and adjust as needed to stay on track.Avoiding Debt

Avoiding debt is an essential aspect of saving money. High-interest debt, such as credit card debt, can be a significant burden on an individual's financial well-being. To avoid debt, individuals should:

- Use cash instead of credit cards

- Avoid impulse purchases

- Create a budget and stick to it

- Pay off existing debt as quickly as possible

Tips for Avoiding Debt

Here are some additional tips for avoiding debt: * Avoid using credit cards for non-essential purchases * Consider using a debit card instead of a credit card * Make multiple payments per month to pay off debt quickly * Consider consolidating debt into a lower-interest loanTax-Advantaged Accounts

Tax-advantaged accounts, such as 401(k) or IRA accounts, can help individuals to save money for retirement while reducing their tax liability. These accounts offer tax benefits, such as deductions or credits, that can help individuals to save more money for retirement.

Types of Tax-Advantaged Accounts

Here are some common types of tax-advantaged accounts: * 401(k) accounts: Employer-sponsored retirement accounts that offer tax deductions for contributions * IRA accounts: Individual retirement accounts that offer tax deductions for contributions * Roth IRA accounts: Individual retirement accounts that offer tax-free growth and withdrawalsAutomating Savings

Automating savings can help individuals to save money consistently and avoid the temptation to spend. By setting up automatic transfers from a checking account to a savings account, individuals can ensure that they save a fixed amount of money regularly.

Benefits of Automating Savings

Here are some benefits of automating savings: * Consistency: Automatic transfers ensure that individuals save a fixed amount of money regularly * Discipline: Automating savings helps individuals to develop a savings habit and avoid the temptation to spend * Convenience: Automatic transfers are easy to set up and require minimal effortSaving Money Image Gallery

What is the best way to save money?

+The best way to save money is to create a budget and stick to it. This involves tracking income and expenses, identifying areas where you can cut back, and allocating funds towards savings.

How can I avoid debt?

+To avoid debt, use cash instead of credit cards, avoid impulse purchases, and create a budget and stick to it. Consider using a debit card instead of a credit card and make multiple payments per month to pay off debt quickly.

What are tax-advantaged accounts?

+Tax-advantaged accounts, such as 401(k) or IRA accounts, offer tax benefits that can help individuals to save more money for retirement. These accounts provide tax deductions or credits that can reduce an individual's tax liability.

In conclusion, saving money is an essential aspect of personal finance that can help individuals achieve their long-term goals and secure their financial future. By creating a budget, automating savings, avoiding debt, and utilizing tax-advantaged accounts, individuals can develop healthy financial habits and achieve financial stability. We hope this article has provided you with valuable insights and tips on how to save money effectively. If you have any questions or comments, please feel free to share them below. Additionally, if you found this article helpful, please consider sharing it with your friends and family to help them improve their financial well-being.