Intro

Calculating simple interest in Excel can be a straightforward process, and it's a fundamental concept in finance and accounting. Simple interest is a type of interest that is calculated only on the principal amount, without taking into account any accrued interest. In this article, we'll explore the importance of calculating simple interest, its benefits, and how to do it in Excel.

The concept of simple interest is crucial in various financial transactions, such as loans, investments, and savings accounts. It helps individuals and businesses understand the cost of borrowing or the return on investment. Simple interest is also used in financial modeling, budgeting, and forecasting. By calculating simple interest, you can make informed decisions about your financial resources and plan for the future.

Simple interest has several benefits, including its simplicity and ease of calculation. It's also a transparent and predictable way to calculate interest, as it's based solely on the principal amount and the interest rate. Additionally, simple interest is often used in short-term financial transactions, such as personal loans or credit card debt. By understanding how to calculate simple interest, you can better manage your finances and avoid costly mistakes.

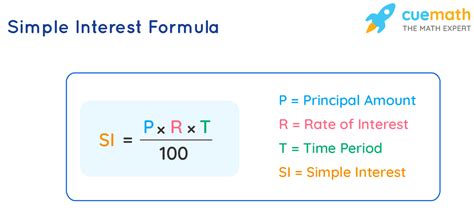

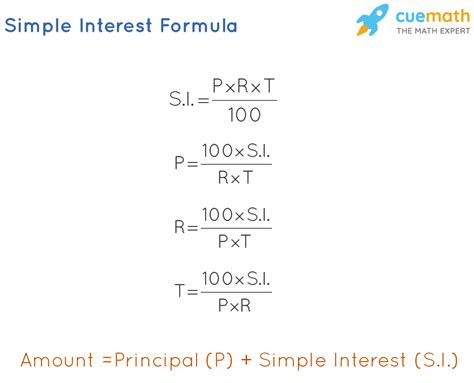

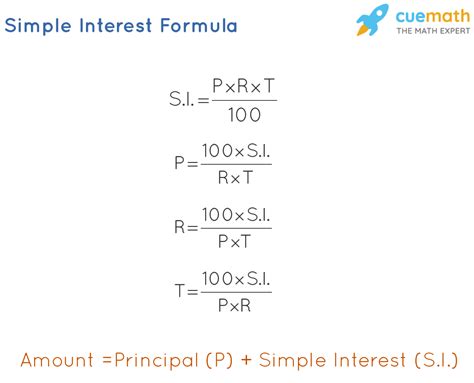

Understanding Simple Interest Formula

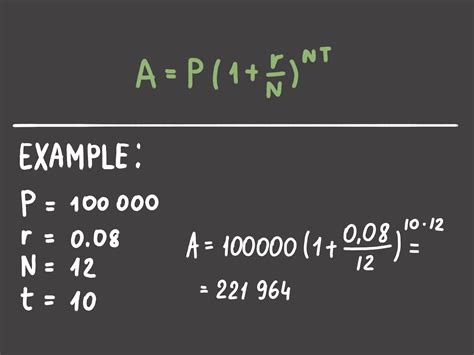

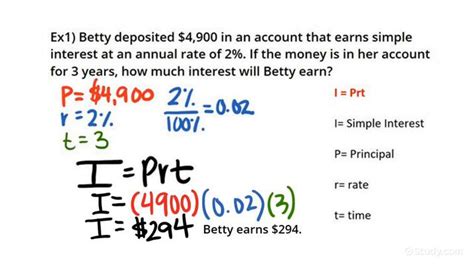

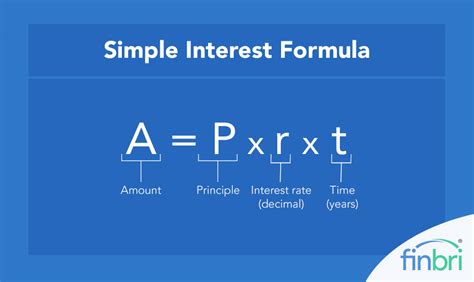

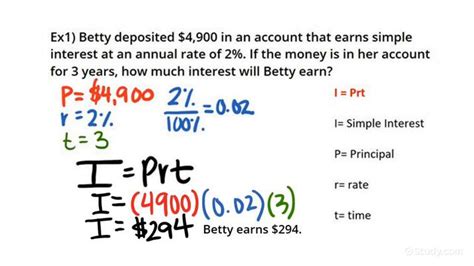

The simple interest formula is I = PRT, where I is the interest, P is the principal amount, R is the interest rate, and T is the time period. This formula is used to calculate the interest earned or paid over a specific period. For example, if you borrow $1,000 at an interest rate of 5% per annum for 2 years, the simple interest would be $100 (I = $1,000 x 5% x 2).

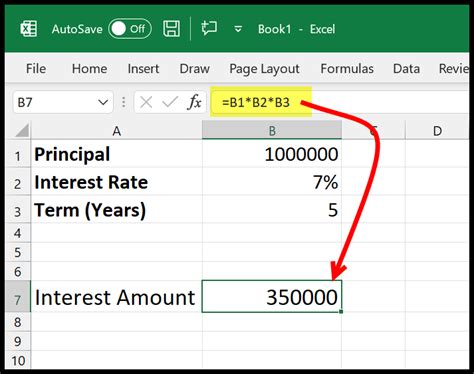

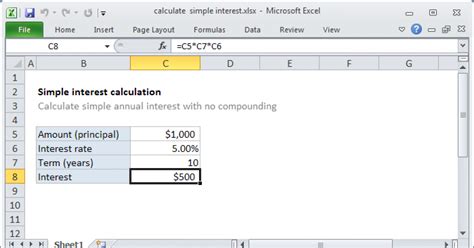

Calculating Simple Interest in Excel

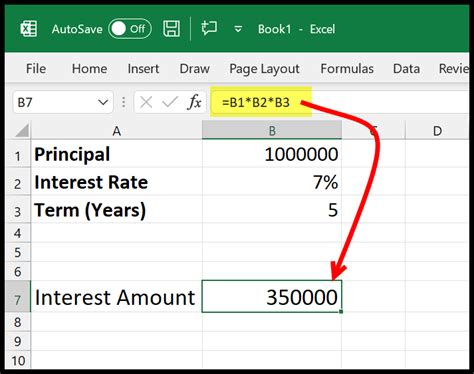

To calculate simple interest in Excel, you can use the formula =PRT, where P, R, and T are the principal amount, interest rate, and time period, respectively. You can also use the IPMT function, which is specifically designed for calculating interest payments. The IPMT function takes four arguments: the interest rate, the number of periods, the present value, and the future value.

Here are the steps to calculate simple interest in Excel:

- Enter the principal amount, interest rate, and time period in separate cells.

- Use the formula =PRT to calculate the simple interest.

- Alternatively, use the IPMT function to calculate the interest payment.

For example, if you enter the principal amount as $1,000, the interest rate as 5%, and the time period as 2 years, the simple interest would be $100.

Example of Simple Interest Calculation

Suppose you want to calculate the simple interest on a loan of $10,000 at an interest rate of 6% per annum for 3 years. You can use the formula =PRT to calculate the simple interest.

- Principal amount (P) = $10,000

- Interest rate (R) = 6% = 0.06

- Time period (T) = 3 years

Simple interest (I) = PRT = $10,000 x 0.06 x 3 = $1,800

Benefits of Calculating Simple Interest

Calculating simple interest has several benefits, including:

- Helps you understand the cost of borrowing or the return on investment

- Enables you to make informed decisions about your financial resources

- Provides a transparent and predictable way to calculate interest

- Is often used in short-term financial transactions, such as personal loans or credit card debt

By calculating simple interest, you can better manage your finances and avoid costly mistakes. It's also essential to understand the concept of simple interest to make informed decisions about your financial resources.

Common Applications of Simple Interest

Simple interest is commonly used in various financial transactions, including:

- Loans: Simple interest is often used to calculate the interest on personal loans, credit card debt, and other types of loans.

- Investments: Simple interest is used to calculate the return on investment for fixed-income investments, such as bonds and certificates of deposit.

- Savings accounts: Simple interest is used to calculate the interest earned on savings accounts and other types of deposit accounts.

By understanding how to calculate simple interest, you can better manage your finances and make informed decisions about your financial resources.

Gallery of Simple Interest Calculations

Simple Interest Calculation Gallery

What is simple interest?

+Simple interest is a type of interest that is calculated only on the principal amount, without taking into account any accrued interest.

How do you calculate simple interest in Excel?

+To calculate simple interest in Excel, you can use the formula =P*R*T, where P, R, and T are the principal amount, interest rate, and time period, respectively.

What are the benefits of calculating simple interest?

+Calculating simple interest helps you understand the cost of borrowing or the return on investment, enables you to make informed decisions about your financial resources, and provides a transparent and predictable way to calculate interest.

In conclusion, calculating simple interest is an essential concept in finance and accounting. By understanding how to calculate simple interest, you can better manage your finances and make informed decisions about your financial resources. Whether you're using Excel or a calculator, calculating simple interest is a straightforward process that can help you achieve your financial goals. We hope this article has provided you with a comprehensive understanding of simple interest and its applications. If you have any further questions or would like to share your experiences with calculating simple interest, please feel free to comment below.