Intro

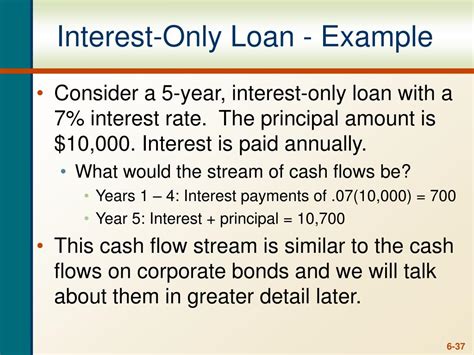

The concept of interest-only amortization schedules is a crucial one in the realm of finance, particularly for individuals and businesses looking to manage their loan repayments effectively. An interest-only loan allows borrowers to pay only the interest on the loan for a specified period, usually during the initial years of the loan term. This can significantly lower the monthly payments during this period but does not reduce the principal amount borrowed. Once the interest-only period ends, the loan typically converts to a principal-and-interest repayment schedule, which can result in significantly higher monthly payments.

Understanding how to create and utilize an interest-only amortization schedule in Excel can be incredibly beneficial for managing such loans. Excel, with its powerful calculation capabilities and flexibility, is an ideal tool for creating personalized amortization schedules that can help borrowers anticipate and plan for their financial obligations.

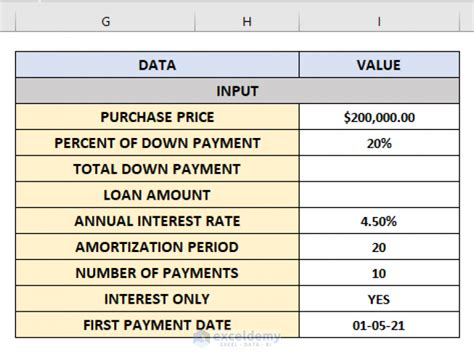

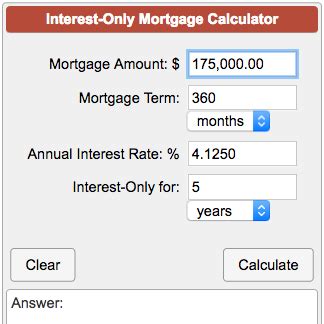

To start creating an interest-only amortization schedule in Excel, one must first gather all the necessary information about the loan. This includes the loan amount (principal), the annual interest rate, the total loan term, and the length of the interest-only period. With this information, one can set up a basic amortization schedule that calculates the monthly payments during both the interest-only period and the subsequent principal-and-interest repayment period.

The formula for calculating the monthly interest payment during the interest-only period is relatively straightforward: Monthly Interest Payment = Principal * (Annual Interest Rate / 12). This formula calculates the interest portion of the monthly payment, which is the only amount paid during the interest-only period.

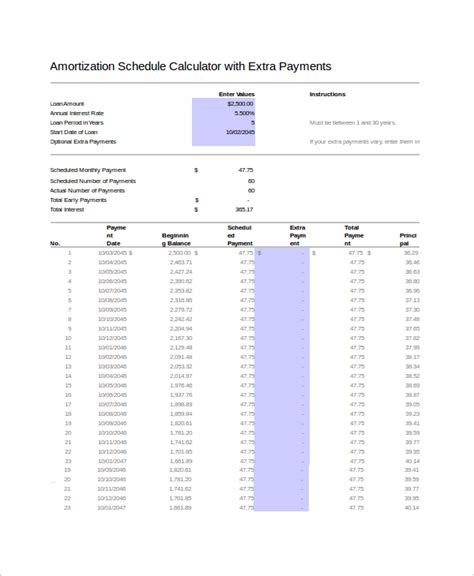

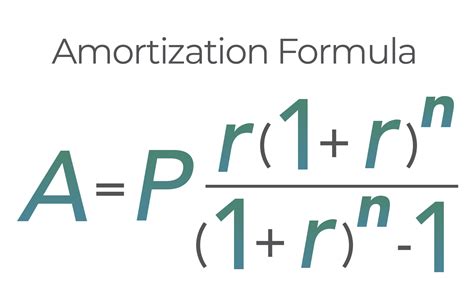

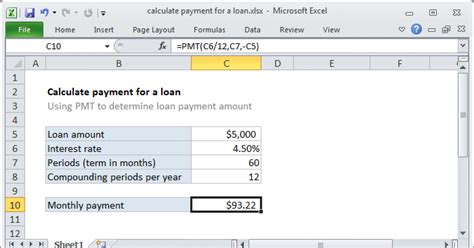

Once the interest-only period ends, the loan converts to a standard amortizing loan, where each monthly payment covers both interest and principal. The formula for calculating the monthly payment (PMT) during this period is more complex and involves using Excel's PMT function: PMT = PMT(rate, nper, pv, [fv], [type]), where rate is the monthly interest rate, nper is the number of payments, pv is the present value (the remaining principal after the interest-only period), and [fv] and [type] are optional arguments that can be omitted for a basic loan calculation.

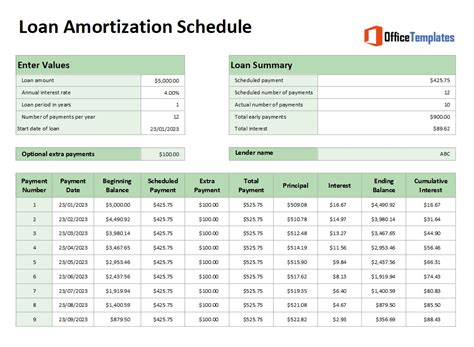

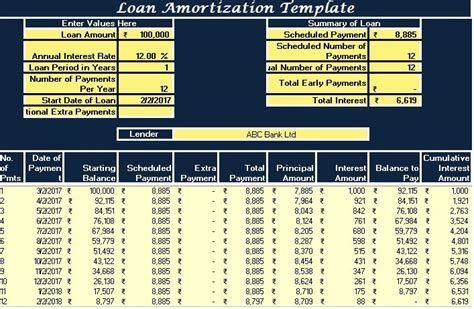

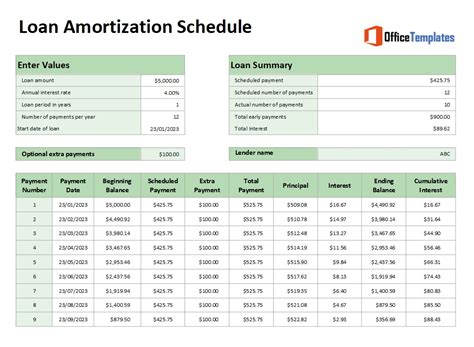

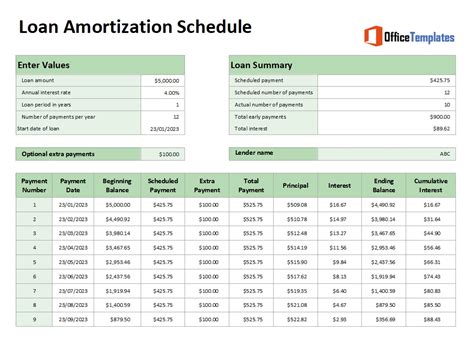

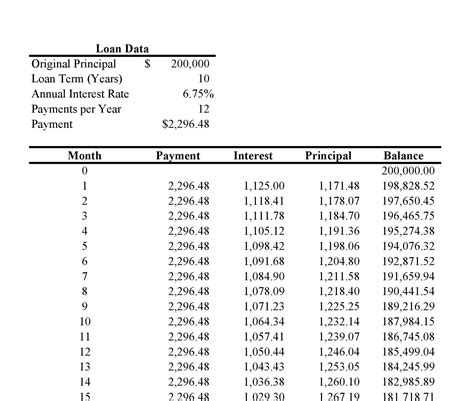

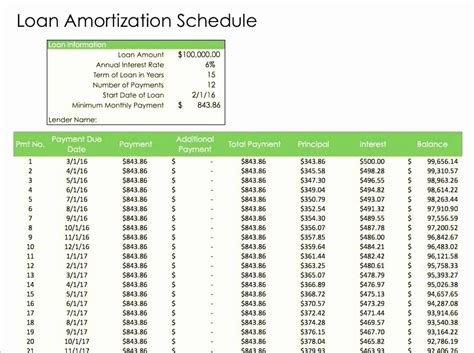

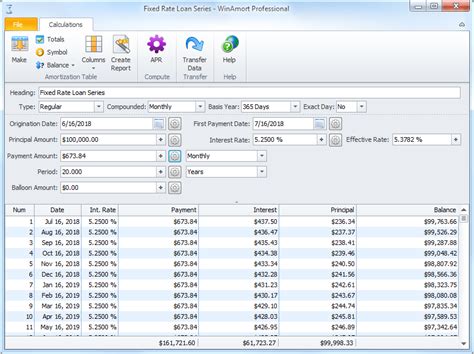

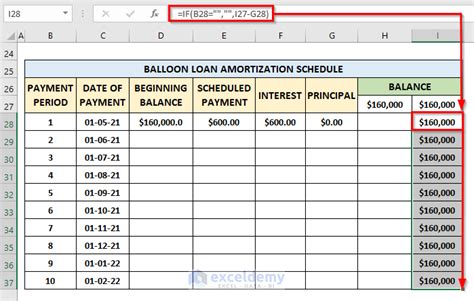

Creating a detailed amortization schedule involves calculating the interest and principal components of each monthly payment over the life of the loan. This can be done by setting up a table in Excel that iterates through each payment period, calculating the outstanding balance, the interest charge for the period, the principal payment (if applicable), and the new outstanding balance after each payment.

Here is a simplified example of how to structure this in Excel:

- Input Section: Dedicate a section at the top of your sheet for input variables such as Loan Amount, Annual Interest Rate, Loan Term in Years, and Interest-Only Period in Years.

- Calculation Section: Below the input section, calculate the monthly interest rate and the number of payments for both the interest-only period and the entire loan term.

- Amortization Schedule Table: Set up a table with columns for Payment Number, Payment Date, Beginning Balance, Interest Payment, Principal Payment, Ending Balance, and Cumulative Interest Paid. Use Excel formulas to populate this table based on the input variables and calculated monthly payments.

For instance, the interest payment during the interest-only period can be calculated as =A2*(B2/12), assuming A2 contains the loan amount and B2 contains the annual interest rate. For the principal-and-interest period, you would use the PMT function to calculate the monthly payment amount and then break down each payment into its interest and principal components based on the outstanding balance and interest rate.

Benefits of Using an Interest-Only Amortization Schedule in Excel

Using Excel to create an interest-only amortization schedule offers several benefits, including the ability to easily adjust variables such as the loan amount, interest rate, and loan term to see how changes affect the repayment schedule. This flexibility allows borrowers to explore different scenarios and make informed decisions about their loan options.

Moreover, having a detailed schedule helps in planning and budgeting, as borrowers can anticipate exactly how much they will need to pay each month and when the payments are due. This can be particularly useful during the transition from the interest-only period to the principal-and-interest repayment period, when monthly payments can increase substantially.

Customizing Your Amortization Schedule

One of the advantages of creating your own amortization schedule in Excel is the ability to customize it to fit your specific needs. For example, you might want to include additional columns to track cumulative principal paid, remaining balance, or even to calculate the effect of extra payments on the loan term and total interest paid.

To take it a step further, Excel's conditional formatting can be used to highlight important milestones or changes in the payment schedule, such as the end of the interest-only period or when the loan is halfway paid off. This visual representation can make the repayment process more manageable and motivating.

Common Challenges and Considerations

While interest-only loans can offer temporary relief in terms of lower monthly payments, they also come with significant risks. The primary concern is the potential for payment shock when the loan converts to a principal-and-interest repayment schedule. Borrowers must ensure they can afford the higher payments; otherwise, they may face difficulties in keeping up with their loan obligations.

Another consideration is the potential for negative amortization if the loan is structured in such a way that the interest-only payments do not cover the full interest charge, leading to an increase in the principal balance over time.

Conclusion and Next Steps

In conclusion, creating an interest-only amortization schedule in Excel is a valuable tool for anyone dealing with interest-only loans. It provides a clear roadmap of the loan repayment process, helping borrowers anticipate and prepare for the financial obligations associated with their loan.

By understanding how to set up and customize an amortization schedule in Excel, individuals can better manage their debt, make informed decisions about their financial future, and navigate the complexities of interest-only loans with confidence.

Gallery of Interest-Only Amortization Schedules

Interest-Only Amortization Schedule Examples

What is an interest-only amortization schedule?

+An interest-only amortization schedule is a table or chart that shows the repayment schedule for an interest-only loan, detailing the interest and principal payments over the life of the loan.

How do I create an interest-only amortization schedule in Excel?

+To create an interest-only amortization schedule in Excel, start by setting up a table with columns for payment number, payment date, beginning balance, interest payment, principal payment, and ending balance. Use Excel formulas to calculate each component based on the loan terms and interest rate.

What are the benefits of using an interest-only amortization schedule?

+The benefits include the ability to anticipate and plan for loan payments, understand the impact of interest rates on the loan, and make informed decisions about loan options. It also helps in managing debt and navigating the complexities of interest-only loans.

We invite you to share your thoughts and experiences with interest-only amortization schedules in Excel. Have you found creating such schedules helpful in managing your loans? What features or functionalities do you think would enhance the usability of Excel for loan amortization calculations? Your insights and questions are valuable, and we look forward to hearing from you. Whether you're a seasoned financial professional or an individual looking to better understand your loan obligations, your input can help others navigate the world of interest-only loans with greater ease and confidence.